Accounting and Artificial Intelligence

“The CFO asks the CEO, ‘What happens if we invest in developing our people and they leave us?’ The CEO responds, ‘What happens if we don’t, and they stay?’”

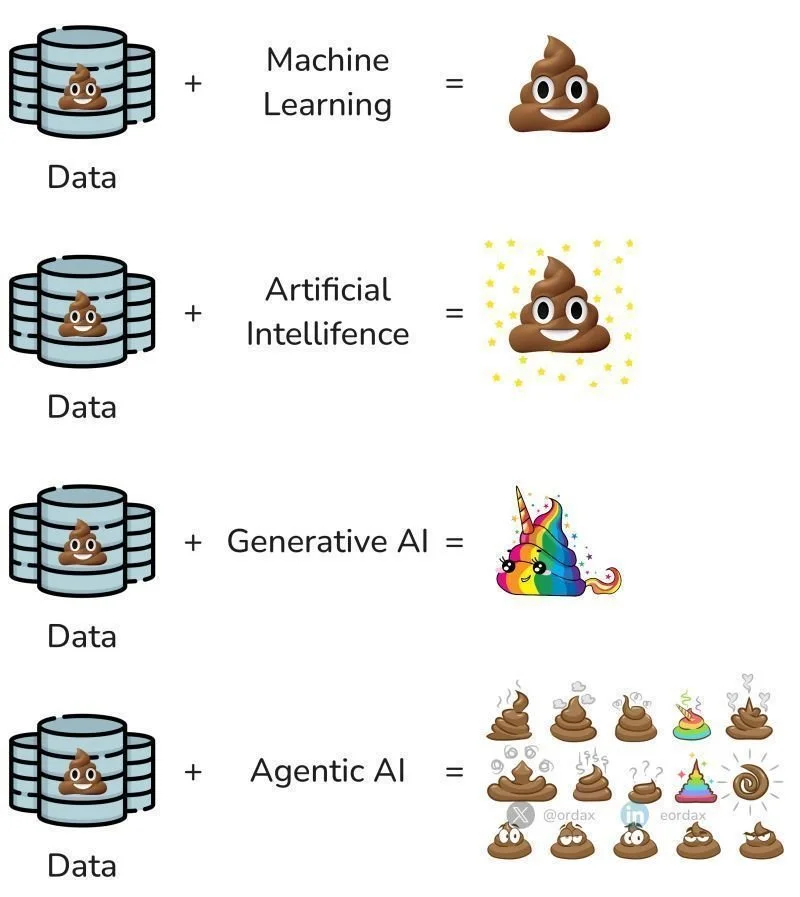

Eduardo Ordax @eordax

A survey commissioned by BlackLine, Inc. in January 2024 reveals that nearly 40% of chief financial officers (CFOs) worldwide do not fully trust the accuracy of financial data coming from their organisation. This makes strategic decision-making even more difficult in an uncertain economic environment.

Confidence in cash visibility is also low, with only 2% of executives expressing complete confidence.

Manual processes and the risk of human error are identified as key factors negatively affecting this confidence. To address this, a majority of organisations are adopting or considering adopting emerging technologies, such as artificial intelligence, to automate their financial operations.

Since AI's high-profile arrival on the public stage, no significant new studies on trust in financial data have emerged that take AI's role into account. But we would not be surprised if the replacement of humans by artificial intelligence resulted in a decline in CFOs' trust in their data rather than an increase.

AI hallucinations and other forms of error are only increasing, amplified by overconfidence in this new form of intelligence.

This raises the question:

Can AI replace part or all of a company's finance function?

Certainly, some transactions will increasingly be handled by machines involving varying degrees of artificial intelligence, such as self-checkouts replacing cashiers, ticket machines replacing station clerks, Waymo gradually replacing car drivers, and Large Language Models (LLMs) capable of writing documents approaching human quality.

But in each of these cases, the quality of the output depends on the quality of the input: an automatic checkout is programmed with all the available products, age restrictions for certain products, different payment methods, etc.

Waymo has been programmed for years on existing roads with cameras and sensors to anticipate as many scenarios as possible.

What large language models write depends on the quality of the information available to them. In principle, they do not invent anything.

The better the quality of the input, the better the result.

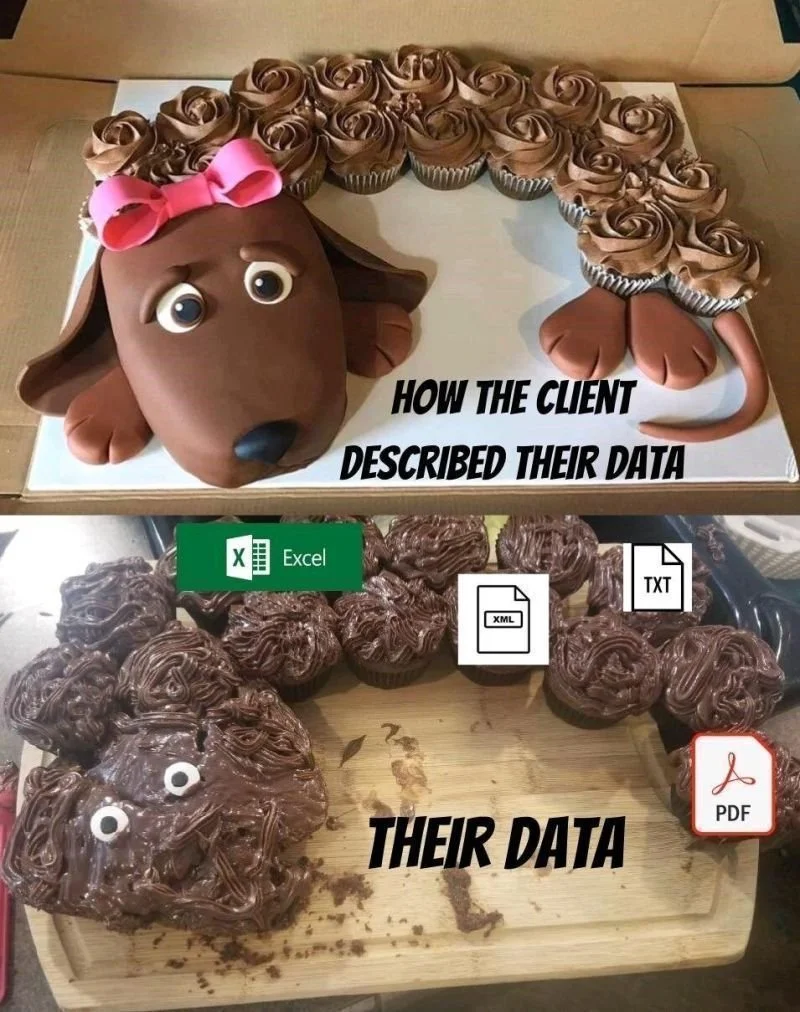

Accounting, particularly for SMEs (up to relatively large sizes of tens of millions of turnover), is very often not kept in a way that allows it to rely on any form of artificial intelligence.

Accounting and corporate finance are human sciences, often relying on multiple systems and data sources that are not always automatically linked to each other and where manual intervention (checks, adjustments, settings, etc.) is essential.

The examples are endless: a customer has gone bankrupt, an employee is on sick leave, the construction of a building is taking longer than expected, the director decides to pay a bonus to his best-performing employees, the employee has not taken his holiday, vouchers have not been used at the end of the year, the contract stipulates that from one million orders onwards, 3% will be paid back, grey areas in different laws leave results open to interpretation by the justice system, etc.

All of these scenarios require human intervention and interpretation of the various elements based on knowledge, including one's own limitations and experience. Only once processes are in place to ensure the quality of data across all accounting possibilities for an event, and processing within a reasonable timeframe, can quality analysis with the assistance of artificial intelligence play a role.

For large companies, despite numerous processes in place, data quality is still a concern for nearly half of CFOs today.

For SMEs, processes are less robust and data quality is often far below that of larger companies.

T. Scott Clendaniel on LinkedIn

This means that almost all of them still have a huge amount of work to do to ensure the quality of their financial and non-financial data. This involves putting processes in place to collect, process and control data before they can then rely in part on artificial intelligence.

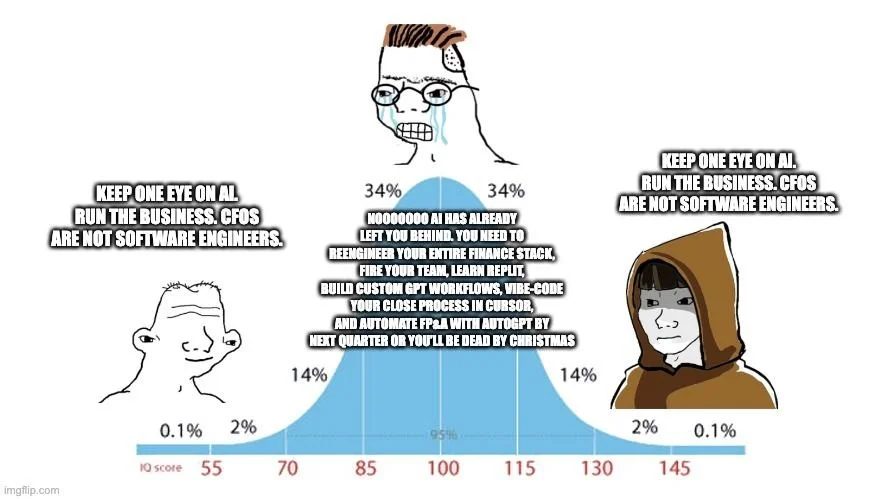

To achieve this, it is essential to continue investing in the human skills of accountants and other corporate finance professionals, otherwise artificial intelligence tools will serve no purpose other than to amplify the impact of poor data quality.

Secret CFO on LinkedIn